Country Spotlight: Payroll in Egypt

What does a payroll professional tell an Egyptian mummy at the end of a pay cycle?

That’s a wrap up on your payment!

Unfortunately, processing payroll in Egypt is no joke. When it comes to paying employees, payroll calculations must ensure compliance and consider many factors, including health insurance, years of service, and more.

Here’s a ready reckoner of everything employers need to consider during payroll processing in Egypt.

What to know when employees are around

A full working day for an employee equates to 8 hours.

A regular payment cycle is strictly followed as employers must pay them monthly, which must be done by the 5th of the following month.

Overtime

- Egypt has an employee-first policy when it comes to overtime rules. The employment laws are cooperative regarding their rest days as the staff is obliged to receive double their pay when they work weekends or vacations. If it is weekends, then it’s either double payment or they must be given another day off in exchange for it.

- If working during daylight hours, they are to be paid a regular rate plus 35% of overtime work. In the case of night shift, the rate increases to 70%.

You may also like: A spotlight on Global Payroll Compliance Requirements in the Middle East and African regions

Employer and Employee Taxes

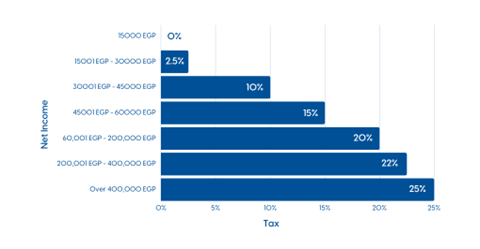

The employee contribution is based on the following income tax slab:

Other contributions include:

Social Security – 11% (Minimum taxable wages is 1,400 EGP and maximum is 9,400 EGP)

Total Employee Cost – 11%

From the employer’s side, there’s usually two major contributions made:

- Social Security – 18.75% (Minimum taxable wage is 1,400 EGP and maximum is 9,400 EGP)

- Unemployment – 1%

This made the Total Employment Cost amount to about 19.75%- 20.75%

Organizations looking to establish an entity in Egypt or already have one must ensure they have a peerless payday experience powered by a configurable, scalable, and accurate time and absence tracking platform. Under such circumstances, it can prove highly effective to employ a provider who can assist in reducing manager overheads and increasing productivity gains.

Neeyamo simplifies global governance of payroll that goes beyond accuracy and timeliness to provide a holistic payroll system. Learn more about the payroll technology that can take care of your payment cycles here.

What to know when employees are not around

Employers must have an employee-centric approach to improving morale and enhancing work culture. Therefore, it becomes even more vital to instill an absence system that seamlessly approves employee leave requests.

Public Holidays

There are 13 public holidays in Egypt, including Prophet Muhammad’s birthday, which changes yearly depending on the lunar calendar.

Sick Leave

In Egypt, a unique feature in terms of leave stands out: if employees wish to, they are liable to convert their annual leave to sick leave.

Employees receive their sick leave benefits through batches:

- With the provision of a certificate of sickness, employees can claim up to 6 months of paid leave

- For the first 90 days, the employee is entitled to 75% of their salary

- For the subsequent 90 days, the employee is entitled to 85% of their salary

Parental Leave

The ideal work-life balance enhances employee morale and productivity and makes organizations more desirable to future employees.

Thereby, Egypt has accommodated rules that allow a woman to take two half-hour nursing breaks or a combined hour each day for 24 months after birth. Furthermore, in workplaces with more than 100 employees, the employer must provide an in-house nursery or is responsible for placing the child in nursery care until the age of schooling.

Female employees contributing to social insurance for the past ten months are entitled to up to 3 months of maternity leave for each child up to three children and are allowed to pay 75% of the last salary.

For work to not be one of the hindrances in family life, Egypt ensures flexible work hours. Mothers are granted 24 months of unpaid leave after childbirth in organizations with more than 50 employees.

Consequently, Egypt presents itself as a good hub for businesses worldwide. But just like other countries, Egypt is not devoid of its challenges. Organizations realize the importance of accurately providing timely payroll to their employees to tackle them.

Keeping employee interest at the forefront, firms everywhere are employing systems that can help take care of that aspect without interfering with their other operations.

Payroll processing is no joke, and the requirement for a global payroll provider is the need of the hour. The right provider can ensure that you can focus on day-to-day operations while leaving the intricacies of payroll to experts.

To gain more insights from our global experts, reach us at irene.jones@neeyamo.com.

Latest Resources

Stay informed with latest updates

If you're curious and have a thirst for knowledge pertaining to the HR, payroll, and EOR universe, don't miss out on subscribing to our resources.