Country Spotlight: Payroll in South Africa

What does a South African superhero wear?

The Cape of Good Hope!

Likewise, the responsibility falls on payroll professionals to give ‘good hope’ to the employees in South Africa and ensure that payroll is processed without delay.

How is payroll processed in South Africa?

Employers should be aware of several aspects of payroll before stepping into the South African territory to ensure a more effortless experience for them and their employees.

However, it should be noted that the number of inputs required for payroll processing and their requirements depends on the employers’ contracts.

Pay frequency

Pay frequency is one such aspect that varies across companies. The pay frequency of different employees can range from weekly to bi-monthly to monthly cycles.

If employers are outsourcing their payroll, their payroll provider must have an efficient approach to feed in the required inputs periodically. Cloud-based software is usually better equipped in this regard, allowing easier user data input and validation processes.

Taxation

Tax calculation plays a critical role in ensuring accurate payroll processing. The South African Revenue Service (SARS), an autonomous organization, acts as the national tax-collecting authority in South Africa.

There are several types of taxes in South Africa that SARS mandates as payable by employers and employees, including Standard Income Tax on Employees (SITE), the Unemployment Insurance Fund (UIF), the Skill Development Levy (SDL), Pay-As-You-Earn (PAYE), and other sector-specific taxes such as International Oil Pollution Compensation Fund Levy and Mineral and Petroleum Resource Royalty.

UIF is directly payable by the employees registered with SARS, and 1% of their remuneration is contributed towards it. It is legislated by the Unemployment Insurance Act of 2001. However, employees are exempted from UIF contributions if:

- They are employed by the employer for less than 24 hours a month

- They are employed as an officer or employee in the national or provincial sphere of the Government

- They are the President, Deputy President, a Minister, Deputy Minister, a member of the National Assembly, permanent delegate to the National Council of Provinces, a Premier, a member of an Executive Council, or a member of a provincial legislature or

- They are a municipal council member, a traditional leader, a member of a provincial House of Traditional Leaders, and a member of the Council of Traditional Leaders.

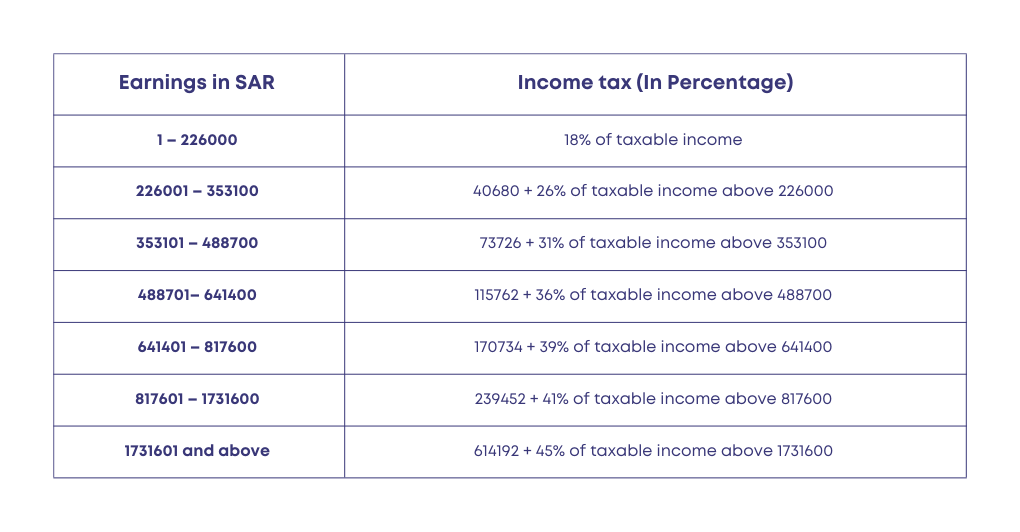

SITE is also an employee payable tax. The income tax rate brackets are as follows:

There are other payroll taxes payable by the employers, such as the Skill Development Levy (SDL), which is a standard amount that is contributed towards the learning and development of employees.

SDL is often automatically deducted by employers as part of PAYE. Employers must pay the amount deducted from employees to SARS every month (usually by the 7th). This is done by completing the monthly employer return, known as the EMP201.

The EMP201 is a mandatory compliance requirement; failing to follow it would incur penalties.

Employers seeking to outsource payroll must be aware of these different taxation requirements and choose a payroll provider who can efficiently and accurately calculate the various tax brackets within the stipulated time.

Leaves and compensations

Employees can work a maximum of 45 hours per week, with a minimum wage of 23.19 SAR (South African Rand) per hour.

They are also entitled to six weeks of sick leave over three years. The employee is entitled to 1 day of sick leave for every 26 days worked during their first six months. From the 7th month, the number of days accrued as sick leave depends on the number of days they work in a week.

Female employees get four months of unpaid maternity leaves. However, they can receive maternity benefits if the employer agrees to provide the payment directed towards UIF.

Combined with the fact that these inputs also depend on the employment contract, a time and absence system that allows customizable data entry becomes essential for processing payroll.

Understanding payroll intricacies

It is no doubt that the rainbow nation has ample opportunities for employment and business development. Accurate and efficient payroll processing is crucial in ensuring a hassle-free payday experience.

With Neeyamo’s Global Payroll solution, companies do not have to worry about the intricacies of payroll.

Powered by the Global Payroll Tech Stack that includes modules like Absence and Compliance, Neeyamo’s solution ensures a streamlined process. Reach out to the payroll experts for more insights at irene.jones@neeyamo.com.

Latest Resources

Stay informed with latest updates

If you're curious and have a thirst for knowledge pertaining to the HR, payroll, and EOR universe, don't miss out on subscribing to our resources.